VoyHoy Wins the Future of Travel Summit Startup Award and Daycation Wins the People’s Choice

VoyHoy an online booking platform, enables users to compare and buy plane, bus, ferry, and train tickets throughout Latin America. VoyHoy won the Future of Travel Summit Startup Award in Miami, FL on February 12, 2018. VoyHoy offers a simple and secure means to acquiring the best deal among thousands of travel tickets.

VoyHoy COO, Ignacio Vial and Co-Founder CEO, Jake Moskowitz winner of the Best Startup.

Daycation a Miami, Florida startup allows travelers to purchase day-by-day access to various hotel amenities, such as the pool or spa, starting at $25 a day. Daycation won the People’s Choice award. Daycation allows for memberships as well as individual 1-day pass purchases.

Matthew Boney Co-Founder Daycation winner of the People’s Choice Award.

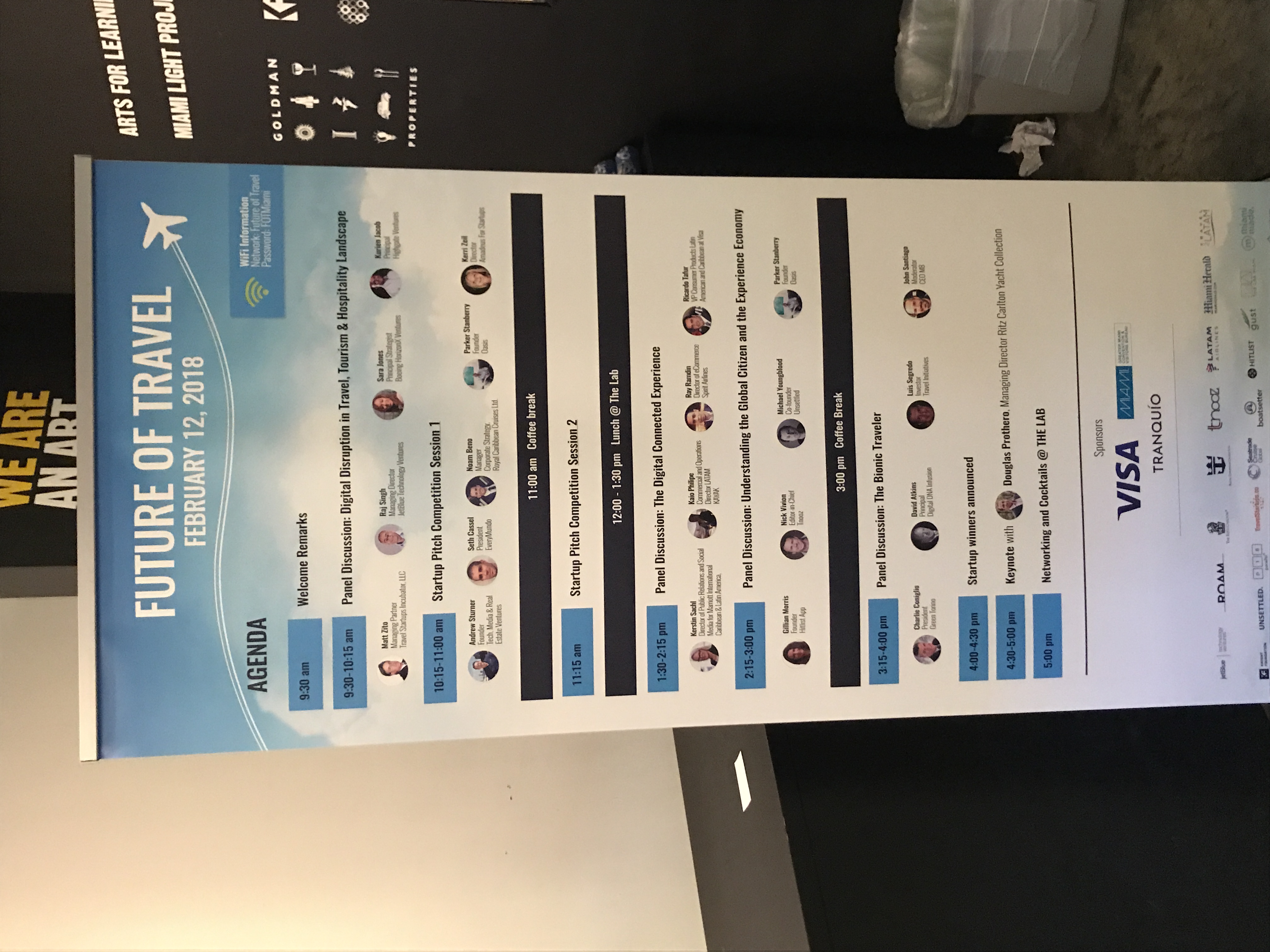

Nicole and I had the pleasure of meeting many startup founders during the conference including both the VoyHoy and Daycation founders. Thanks to Raj Singh, JetBlue Ventures, Sara Jones, Boeing HorizonX Ventures and Kurien Jacob, Highgate Ventures for participating on the investor panel. You provided great insight for the travel companies in the room. Finally, special thanks to Pamela Granoff, Marianna Lopez and Tigre Wenrich for inviting Travel Startups Incubator to participate at the conference hosted by The Lab Miami. We will be back!

Investor Panel: Matt Zito, Moderator TSI, Raj Singh JetBlue, Sara Jones Boeing, Kurien Jacob Highgate

Pictures from the event: